Credit card debt Program Insurance coverage Ratio (DSCR) lending options are usually particular financial products which can be usually utilized by buyers inside real-estate and also organizations. These kinds of lending options are usually slightly organized to be able to prioritize the particular borrower’s revenue relative to their particular present credit card debt commitments. DSCR lending options are usually attractive to people wanting to broaden their particular portfolios or perhaps control continuous jobs, while they offer capital good applicant’s cashflow as opposed to standard revenue records.

Comprehending the debt Program Insurance coverage Ratio (DSCR)

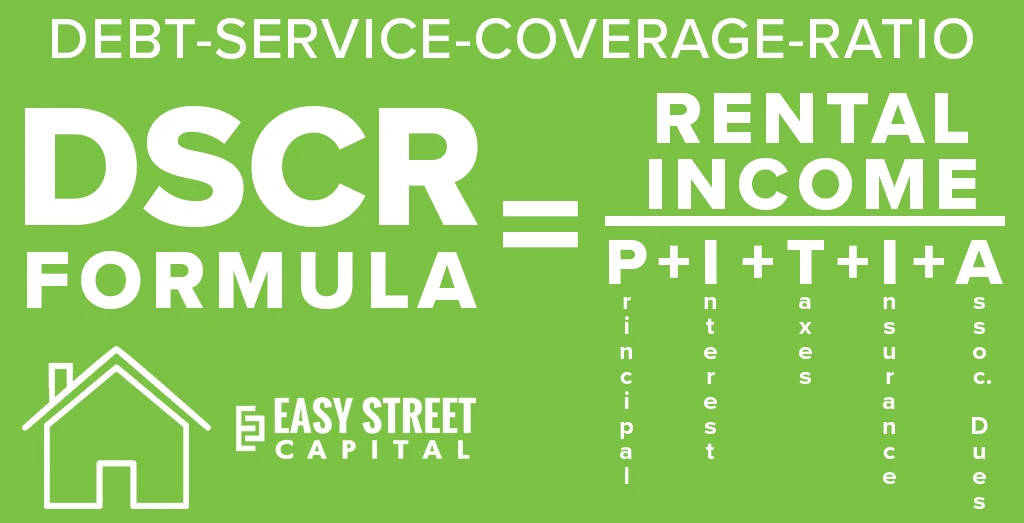

The debt Program Insurance coverage Ratio can be a economic metric as used by loan providers to be able to examine any borrower’s capability pay off credit card debt. It really is computed simply by dividing the particular borrower’s web running revenue simply by their particular overall credit card debt commitments. The effect, displayed being a ratio, gives perception in to the borrower’s economic well being. As an example, any DSCR of 1. twenty-five suggests the debtor provides 25% extra income as compared to their particular credit card debt specifications, which can be generally an acceptable margin for most loan providers.

When it comes to DSCR lending options, loan providers assume the particular ratio being no less than 1. 0, which means the particular revenue created is What is Dscr Loan sufficient to pay the debt repayments. An increased DSCR ratio typically shows far better economic stableness and also may lead to a lot more positive bank loan phrases. Nonetheless, regarding consumers using a reduced DSCR, the likelihood of getting qualified to get a bank loan could be lowered except if the provider accepts specific mitigations or higher interest levels.

Just how DSCR Lending options Perform

As opposed to standard lending options that require substantial revenue records, DSCR lending options give attention to cashflow because the major determinant regarding eligibility. Loan providers examine any borrower’s DSCR ratio simply by studying economic assertions and also planned revenue. This kind of overall flexibility rewards self-employed men and women and also real-estate buyers which may well not have got steady month to month revenue yet carry out create significant cashflow.

DSCR lending options tend to be in owning a home, while they enable consumers to be able to power the particular local rental revenue from other attributes to be able to meet the criteria. The amount of money movement coming from these kinds of attributes aids these illustrate a sufficient DSCR, permitting these to fund further assets. These kinds of lending options furthermore offer you competing interest levels, while they create a lower chance regarding loan providers as a result of give attention to cashflow as opposed to job historical past or perhaps private revenue.

Features of DSCR Lending options

Overall flexibility inside Diploma

DSCR lending options provide an choice if you are together with non-traditional revenue options, creating these available to be able to internet marketers and also real-estate buyers.

A smaller amount Records Necessary

Given that these kinds of lending options count on cashflow as opposed to revenue records, they will entail much less forms specifications, streamlining the particular loan application method.

Prospect of Increased Bank loan Sums

Consumers together with large DSCR proportions may well be eligible for greater bank loan sums, allowing them to fund considerable assets or perhaps large-scale jobs.

Interest Buyers

DSCR lending options are usually specifically useful regarding house buyers, while they are able to use local rental revenue to be able to meet the criteria and also probably broaden their particular portfolios.

Hazards Connected with DSCR Lending options

Although DSCR lending options offer you significant rewards, they may be not necessarily with out hazards. Consumers together with fluctuating revenue ranges may find that tough to keep up the particular DSCR ratio in the course of monetary downturns. In addition, due to the fact these kinds of lending options give attention to cashflow, there is strain about consumers to keep up regular local rental or perhaps enterprise revenue. Any momentary drop inside revenue can impact the particular DSCR ratio, probably ultimately causing troubles inside bank loan repayment schedules.

Which Should be thinking about any DSCR Bank loan?

DSCR lending options are usually suitable regarding real-estate buyers, self-employed men and women, and also companies. This kind of bank loan sort is perfect for those that create significant cashflow coming from assets yet may well not have got standard job revenue. Consumers inside these kinds of classes usually believe it is tough to be able to be eligible for standard lending options as a result of fluctuating revenue water ways, creating DSCR lending options a unique alternative.

Buyers trying to broaden their particular real-estate holdings or perhaps fund huge jobs usually count on DSCR lending options. These kinds of lending options allow them to be able to power their particular existing cashflow to be able to protected capital with out substantial revenue records. Regarding companies which prioritize progress, DSCR lending options give a adaptable remedy in which aligns making use of their funds flow-centric economic users.

Bottom line

To conclude, DSCR lending options certainly are a beneficial application regarding consumers which create steady cashflow coming from assets or perhaps organizations. Simply by emphasizing the debt program insurance coverage ratio, loan providers assess the borrower’s capability control credit card debt by means of revenue as opposed to standard job records. Together with adaptable diploma standards and also much less records specifications, DSCR lending options are usually a nice-looking alternative regarding real-estate buyers and also self-employed men and women.

Although DSCR lending options offer you noteworthy rewards, they will have hazards, specifically inside fluctuating revenue cases. For anyone together with regular local rental revenue or perhaps steady cashflow, nonetheless, these kinds of lending options supply a sensible and also successful capital remedy.